Private mortgage insurance, or PMI, is often required when a homebuyer makes a down payment of less than twenty percent. While PMI helps lenders reduce risk, it adds extra cost to your monthly mortgage payment. The good news is that you may be able to remove PMI without refinancing your loan. Understanding the options available can help you save money and accelerate building equity in your home.

Private mortgage insurance, or PMI, is often required when a homebuyer makes a down payment of less than twenty percent. While PMI helps lenders reduce risk, it adds extra cost to your monthly mortgage payment. The good news is that you may be able to remove PMI without refinancing your loan. Understanding the options available can help you save money and accelerate building equity in your home.

Understand When PMI Can Be Removed

Federal law, specifically the Homeowners Protection Act, requires lenders to automatically cancel PMI once your loan balance reaches eighty percent of the original home value. You can also request cancellation when you believe you have reached this threshold through paying down the loan or if your property has appreciated in value.

Request PMI Cancellation Through Your Lender

If you have built equity to at least twenty percent of the home’s original purchase price, you can formally request that your lender remove PMI. To do this, you typically need to submit a written request and may have to prove the home has not declined in value. Your lender may require a home appraisal to confirm current value.

Use Home Appreciation to Your Advantage

If your property value has increased significantly since purchase, you might qualify for PMI removal sooner. A professional appraisal can demonstrate this increase in equity. Keep in mind that lenders generally want to see that you have at least twenty percent equity in the home before canceling PMI.

Make Extra Principal Payments

Consider Loan Recast if Available

Some lenders offer loan recasting, which recalculates your monthly payments based on your current loan balance after a lump sum payment. While recasting does not remove PMI by itself, lowering your principal faster can bring you closer to that twenty percent equity goal.

Stay Informed and Keep Documentation

Keep track of your loan balance, home value, and payment history. Staying informed empowers you to know when you are eligible to request PMI removal. Document all communications with your lender to avoid misunderstandings.

Consult Your Mortgage Professional

Every loan and lender may have different rules regarding PMI removal. Working with your mortgage expert can help you understand your specific loan terms and options. They can guide you through the process and help you make decisions that save you money.

Removing PMI without refinancing is a smart way to reduce your monthly expenses without the cost or hassle of a new loan. By monitoring your equity and staying proactive, you can enjoy greater savings and faster progress toward full homeownership.

We love our pets, they are part of the family. But did you know that your furry (or feathered) friend could play a surprising role in your homebuying journey? While your dog probably will not impact your credit score, being a pet owner can influence where and how you buy a home, and even the type of loan you choose.

We love our pets, they are part of the family. But did you know that your furry (or feathered) friend could play a surprising role in your homebuying journey? While your dog probably will not impact your credit score, being a pet owner can influence where and how you buy a home, and even the type of loan you choose. When you’re thinking about buying a home, you may hear a lot about mortgage rates going up or down. But have you ever wondered what causes these changes? One of the biggest influences on mortgage rates is the Federal Reserve, often called “the Fed.” While the Fed doesn’t set mortgage rates directly, its policies play a major role in how much you’ll pay for your home loan. Let’s break it down in simple terms:

When you’re thinking about buying a home, you may hear a lot about mortgage rates going up or down. But have you ever wondered what causes these changes? One of the biggest influences on mortgage rates is the Federal Reserve, often called “the Fed.” While the Fed doesn’t set mortgage rates directly, its policies play a major role in how much you’ll pay for your home loan. Let’s break it down in simple terms: Imagine you are about to purchase your dream home, and a generous financial gift from family or friends is making it possible. It’s a moment to celebrate! But did you know that mishandling gift funds can lead to delays, added stress, or even jeopardize your loan approval?

Imagine you are about to purchase your dream home, and a generous financial gift from family or friends is making it possible. It’s a moment to celebrate! But did you know that mishandling gift funds can lead to delays, added stress, or even jeopardize your loan approval? Imagine that you are exploring your city or a new city and you stumble upon your dream home. It is perfect! With an open kitchen for entertaining, a backyard oasis for relaxation, and all the space you’ve envisioned. Just as you’re ready to make your move, someone else beats you to it because your finances weren’t prepared. The good news is you can avoid it with a little preparation.

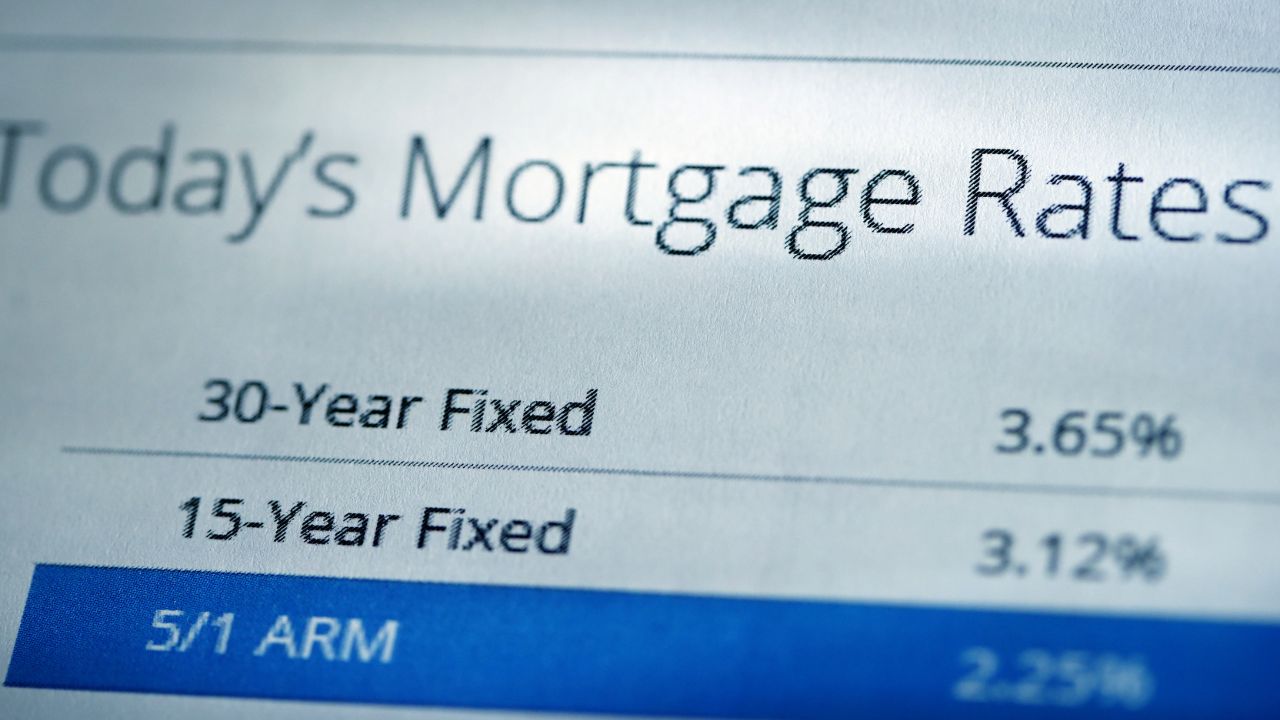

Imagine that you are exploring your city or a new city and you stumble upon your dream home. It is perfect! With an open kitchen for entertaining, a backyard oasis for relaxation, and all the space you’ve envisioned. Just as you’re ready to make your move, someone else beats you to it because your finances weren’t prepared. The good news is you can avoid it with a little preparation. Mortgage rates play a significant role in determining how much home you can afford. These rates influence the cost of borrowing money for your mortgage, which directly impacts your monthly payment and, ultimately, your home buying power.

Mortgage rates play a significant role in determining how much home you can afford. These rates influence the cost of borrowing money for your mortgage, which directly impacts your monthly payment and, ultimately, your home buying power. For many potential homeowners, the dream of buying a house can feel out of reach, especially when saving for a large down payment or dealing with credit challenges. That’s where FHA loans come in. Backed by the Federal Housing Administration, these loans have become a go-to option for first-time homebuyers and others looking for accessible and flexible financing options.

For many potential homeowners, the dream of buying a house can feel out of reach, especially when saving for a large down payment or dealing with credit challenges. That’s where FHA loans come in. Backed by the Federal Housing Administration, these loans have become a go-to option for first-time homebuyers and others looking for accessible and flexible financing options. Balancing two jobs or a full-time career with a side hustle can be rewarding, not just for your wallet but also when it comes to qualifying for a mortgage. Lenders recognize that additional income can strengthen your application, but there are specific rules to ensure your income is reliable and sustainable.

Balancing two jobs or a full-time career with a side hustle can be rewarding, not just for your wallet but also when it comes to qualifying for a mortgage. Lenders recognize that additional income can strengthen your application, but there are specific rules to ensure your income is reliable and sustainable. Scams are everywhere, and the mortgage world is no exception. As you start the exciting journey of homeownership, it’s essential to be aware of the potential risks and arm yourself with knowledge to protect your investment. Here’s what you need to know about common mortgage scams and how to safeguard your financial future.

Scams are everywhere, and the mortgage world is no exception. As you start the exciting journey of homeownership, it’s essential to be aware of the potential risks and arm yourself with knowledge to protect your investment. Here’s what you need to know about common mortgage scams and how to safeguard your financial future. Purchasing a condo can be an exciting step, offering a more affordable option or an appealing lifestyle in certain areas. However, financing a condo differs significantly from securing a mortgage for a single-family home. These differences arise from the shared nature of condo ownership, affecting the underwriting process, appraisal requirements, insurance needs, and sometimes even the interest rate. Understanding the nuances of condo financing will help you make more informed decisions when it comes time to purchase a condo.

Purchasing a condo can be an exciting step, offering a more affordable option or an appealing lifestyle in certain areas. However, financing a condo differs significantly from securing a mortgage for a single-family home. These differences arise from the shared nature of condo ownership, affecting the underwriting process, appraisal requirements, insurance needs, and sometimes even the interest rate. Understanding the nuances of condo financing will help you make more informed decisions when it comes time to purchase a condo.