How Non-Occupant Co-Borrowers Can Help with Mortgage Qualification

Many hopeful homebuyers find that their income alone does not quite meet the requirements for a mortgage. This challenge is especially common for people early in their careers, those recovering from financial setbacks, or buyers facing higher home prices. One option that can make a meaningful difference is bringing in a non-occupant co-borrower.

Read More

What’s Ahead For Mortgage Rates This Week – November 24th, 2025

This week finally got a strong release of regularly scheduled data, with unemployment figures coming out first, along with employment-rate data. The prior week included the Consumer Price Index, which came in favorable. Some of the unemployment-related numbers, however, weren't as telling as they could be: the forecast was roughly 50,000, but the actual figure landed closer to 110,000. That's an order-of-magnitude miss, suggesting we may need to allow some time for the data to self-correct.

Read More

Understanding the Conversation Around Longer Mortgage Terms

The idea of extending mortgage terms well beyond the traditional thirty years is gaining new attention. With rising home prices and tightened affordability, many buyers are wondering whether a much longer loan could help lower the monthly payment enough to make homeownership more achievable. Before deciding if this type of option makes sense, it is important to look at why the concept is being discussed and what it could mean for buyers in the real world.

Read More

A Season of Generosity and Homeownership Opportunities

The time between Thanksgiving and the New Year is known for gratitude, togetherness and heartfelt giving. Many families share meaningful gifts during this stretch of the year, and some buyers discover that these seasonal acts of generosity can help make homeownership possible. If you have found the right home but need help with upfront costs, financial gifts from loved ones may be the support that brings your plans together.

Read More

Understanding How Debt Affects Your Ability to Buy a Home

Many future buyers think they must eliminate every debt before applying for a mortgage. Reducing debt is helpful, but it is not a requirement for homeownership. You can qualify for a loan even if you have credit cards, student loans or a car payment. What matters most is how well you manage those obligations and how they fit into your overall financial picture.

Read More

Mortgages for Vacation Homes vs. Airbnb Rentals

Owning a second home is a dream for many people, whether it is a quiet cabin by the lake, a beachfront retreat, or a mountain getaway. For others, that dream also comes with the potential to generate income through short-term rentals. However, mortgages for vacation homes and Airbnb properties are not the same. Lenders view these two types of homes differently, and understanding those differences can help you choose the right financing option for your goals.

Read More

The History of Mortgages From Ancient Times to Modern Loans

The idea of borrowing money to buy property may seem like a modern concept, but the foundation of the mortgage has been around for thousands of years. From ancient civilizations to today's digital lending platforms, the mortgage has evolved alongside society's approach to property ownership, wealth, and security. Understanding where it began offers a fascinating look at how this essential part of homeownership came to be.

Read More

Natural Disasters and Mortgages: Forbearance and Insurance Options

When natural disasters strike, homeowners can find themselves facing unexpected challenges. From hurricanes and floods to wildfires and tornadoes, these events can cause major property damage, income loss, and emotional stress. If you have a mortgage, knowing your options for forbearance and insurance relief can make a significant difference in how you recover financially and protect your home.

Read More

Mortgage Options for Retirees Who Still Want to Buy

Many retirees still dream of owning a new home, whether to downsize, move closer to family, or enjoy a change of scenery. While retirement often means leaving behind a steady paycheck, it does not have to mean leaving behind the dream of homeownership. Lenders understand that retirees have unique financial situations, and there are several mortgage options available to help make that next move possible.

Read More

Honoring Veterans Day, and Celebrating Homeownership

Today, we pause to honor the brave men and women who have served our country. Your courage, sacrifice, and dedication protect the freedoms that allow us all to call this nation home.

Read More

What’s Ahead For Mortgage Rates This Week – November 10th, 2025

With the government shutdown heading into a possible resolution, there were still delays on important data such as employment report releases. This has been somewhat relieved with the release of other reports that have been delayed in the past within the current government shutdown.

Read More

When and How to Secure a Favorable Mortgage Rate Lock

Interest rates can fluctuate from one week to the next, and that can have a major impact on your monthly payment and overall loan cost. A mortgage rate lock gives you the ability to secure your interest rate for a set period of time, protecting you from unexpected increases while your loan is being finalized. Understanding how rate locks work can help you choose the right time and terms for your situation.

Read More

What to Expect at Your First Mortgage Appointment

Meeting with a lender for the first time is a big step in your homebuying journey. Whether you are buying your first home or upgrading to your next one, your mortgage appointment sets the stage for what comes next. Knowing what to expect helps you feel confident, prepared, and ready to make the most of that important conversation.

Read More

What Mortgage Lenders Really Look At Before Approving Your Loan

One of the first questions homebuyers ask is how much they can afford to borrow. While the number may seem mysterious, lenders use a clear set of financial factors to decide how much you qualify for. Understanding these factors can help you plan ahead, make smart choices, and feel confident as you start your homebuying journey.

Read More

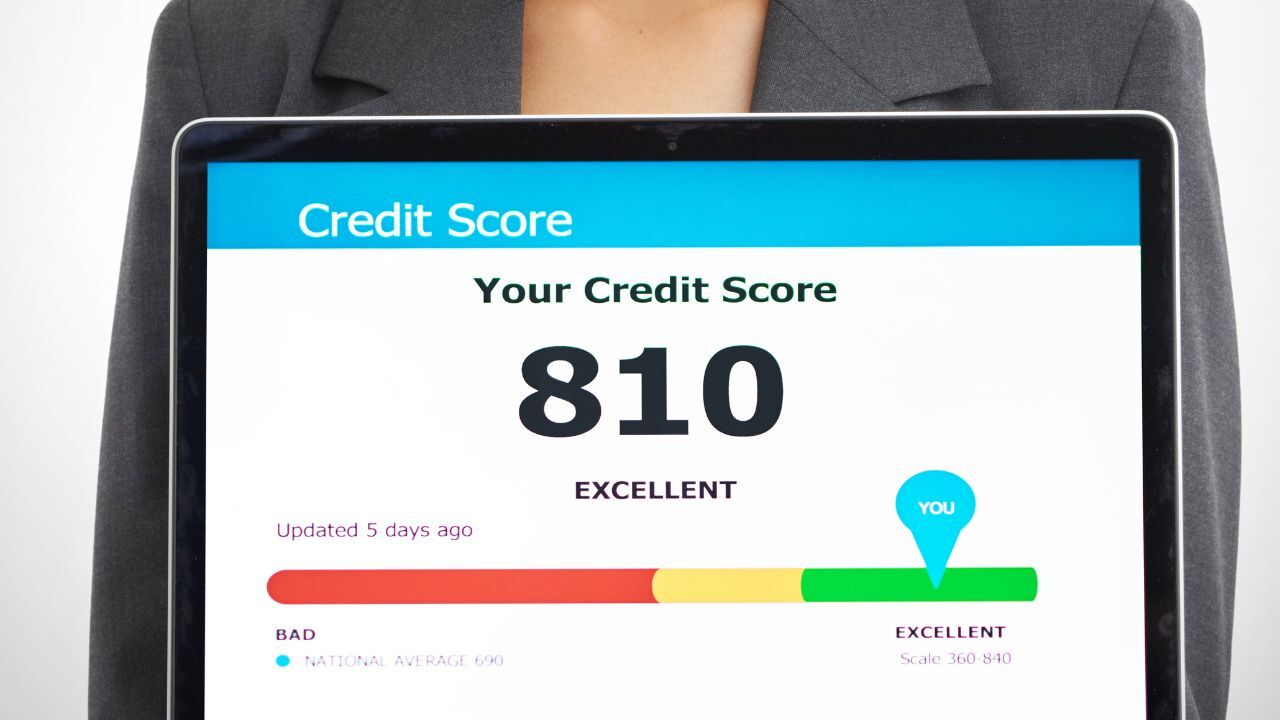

Steps to Take Now to Build Your Credit for a Home Purchase Next Year

Buying a home is one of the most exciting goals you can set, but your credit score plays a major role in how easy or challenging the process will be. The good news is that with time and planning, you can strengthen your credit and set yourself up for a smoother approval when you are ready to buy next year.

Read More

What’s Ahead For Mortgage Rates This Week – November 3rd, 2025

With the ongoing government shutdown, other major releases have hit a snag, as there is still very limited information for when the shutdown may end. The largest and most impactful releases continuing to move forward are those from third-party sources still publishing data -- such as the Consumer Sentiment report -- which shows that consumers remain concerned about inflation but have recently grown more optimistic about the labor market.

Read More

Comparing Biweekly Payments and Lump Sum Payments to See Which Saves More

Homeowners looking to save on interest or shorten their loan term often explore two popular strategies: biweekly payments and lump sum payments. Both can reduce the total interest paid and help you build equity faster, but they work in different ways. Understanding how each method functions can help you decide which fits your financial goals and lifestyle best.

Read More

Understanding the Pros and Cons of Using HELOCs to Fund Investments

A Home Equity Line of Credit, or HELOC, can be a powerful financial tool. It allows homeowners to borrow against the equity in their property, often at a lower interest rate than other types of credit. Some borrowers use HELOCs to fund investments such as real estate, business ventures, or the stock market. While this strategy can create opportunities, it also carries significant risks that must be carefully weighed.

Read More

Should You Wait to Buy a Home Until Rates Drop?

Many buyers are wondering if now is the right time to purchase a home or if they should wait for mortgage rates to fall. It is a fair question, especially when rates fluctuate and the headlines make it seem like waiting could save thousands. Understanding what affects rates, prices, and long-term value can help you make a confident decision that fits your financial goals.

Read More

Understanding Mortgages and Inflation and How Borrowers Can Benefit

Inflation affects nearly every part of the economy, from grocery prices to the cost of borrowing. For homeowners and buyers, understanding how inflation impacts mortgage rates and payments can be a powerful advantage. While rising prices can feel discouraging, there are strategic ways borrowers can benefit during inflationary periods.

Read More